From the "left hand doesn't know what the right hand is doing" department...

-

@Maciejasjmj said:

@anonymous234 said:

@Maciejasjmj said:

What I'm still surprised about is that online stores require all various kind of authenticating information... all of which are found on the very card itself. Here in Poland, some banks implement extensions to that - for example, my bank requires me to log into my Internet account and provide a SMS token - but I've still seen a lot of places where if you have a card, no matter if it's actually yours or not, you can buy whatever the hell you like. Just put that CVV code on a separate piece of paper when you give me a card, goddamnit.

Great, you just made Bitcoin seem like a sane system by comparison. (which it actually is even though community's shit)

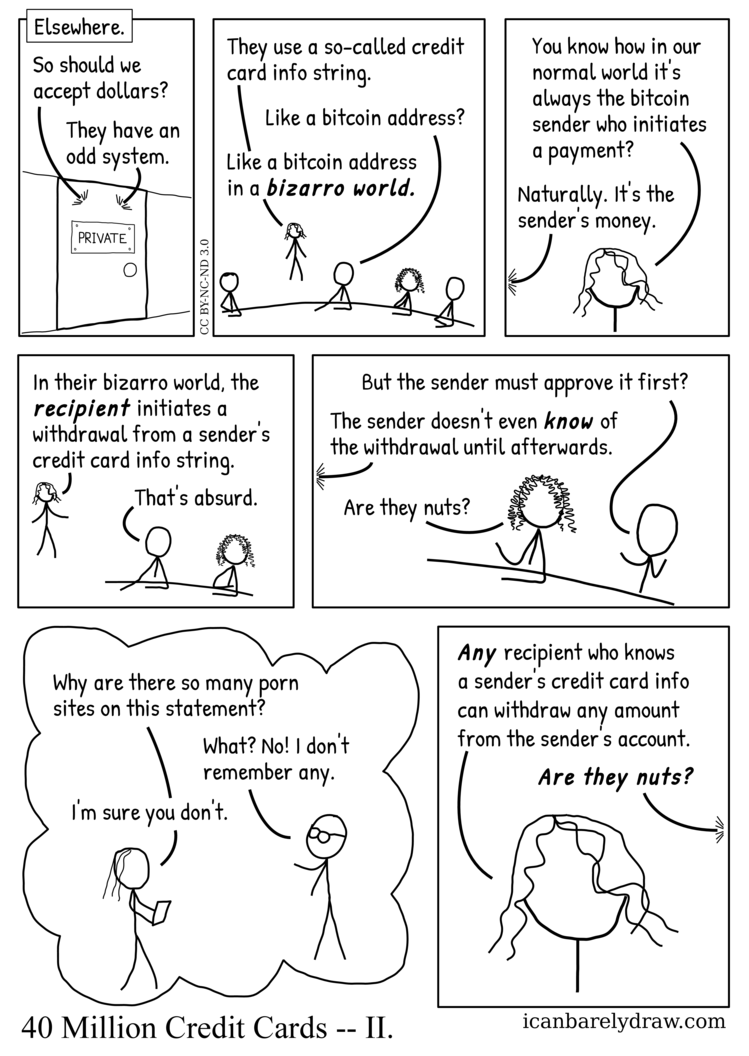

Technically, the comic showed that bitcoin is a better method of transferring money than credit cards. Which is true.

-

@Ben L. said:

Technically, the comic showed that bitcoin is a better method of transferring money than credit cards. Which is true.

Right. With Bitcoin, unlike credit cards, the transaction clears within a second or two. ... oh wait no it doesn't. But at least Bitcoin has a method of refunding fradulent transactions. ... oh wait it doesn't have that either. Well, at least simple devices without gigabytes of storage can verify Bitcoin accounts before doing a transac-- oh wait. Damn.

-

@blakeyrat said:

@Ben L. said:

Technically, the comic showed that bitcoin is a better method of transferring money than credit cards. Which is true.

Right. With Bitcoin, unlike credit cards, the transaction clears within a second or two. ... oh wait no it doesn't. But at least Bitcoin has a method of refunding fradulent transactions. ... oh wait it doesn't have that either. Well, at least simple devices without gigabytes of storage can verify Bitcoin accounts before doing a transac-- oh wait. Damn.

Perhaps someone should tell them about how Credit actually works? How the seller of the goods or services hasn't actually got your money immediately? Or why drawing real cash on your credit card costs so much in charges?Bitcoin does work as an improved Money Transfer mechanism. (With all the extra fun of another currency dominated by speculators, but hey ho.)

-

@blakeyrat said:

@Ben L. said:

Technically, the comic showed that bitcoin is a better method of transferring money than credit cards. Which is true.

Right. With Bitcoin, unlike credit cards, the transaction clears within a second or two. ... oh wait no it doesn't. But at least Bitcoin has a method of refunding fradulent transactions. ... oh wait it doesn't have that either. Well, at least simple devices without gigabytes of storage can verify Bitcoin accounts before doing a transac-- oh wait. Damn.

Transaction clears within between 10 minutes to about an hour, based on your desired level of security (a lot of places use ~20 and it seems enough). Probably would piss you off in a shop, but online it's not a big deal. That is true, though, it should be less.

There's no method of refunding fraudulent transactions because there are no fraudulent transactions (in the credit card meaning of the word). There's no way for someone who got money from you to later withdraw $infty from your account. And if somebody stole your private key, then you suck and deserve to be robbed, tough life. If someone steals your wallet on the street, do you also go to a bank for a refund?

And yeah, devices with gigabytes of storage very much can verify Bitcoin account and transactions. You know it's not 1999 and you can host such stuff in the cloud (which has already been done), and all you need is a thin client?

-

@Maciejasjmj said:

There's no method of refunding fraudulent transactions because there are no fraudulent transactions (in the credit card meaning of the word).

Except you still have the other kinds of fraud — essentially where someone promises to provide a good or service and then doesn't — and credit cards protect much more strongly against that precisely because of the delay between the contract being signed and the delivery of the money. (It gives the buyer a chance to find out that they're being scammed and put a stop to the transaction before it completes. The fraud isn't done until the fraudster's got the money and fled.)

-

@dkf said:

@Maciejasjmj said:

There's no method of refunding fraudulent transactions because there are no fraudulent transactions (in the credit card meaning of the word).

Except you still have the other kinds of fraud — essentially where someone promises to provide a good or service and then doesn't — and credit cards protect much more strongly against that precisely because of the delay between the contract being signed and the delivery of the money. (It gives the buyer a chance to find out that they're being scammed and put a stop to the transaction before it completes. The fraud isn't done until the fraudster's got the money and fled.)Yeah, but then it's not a transaction that's fraudulent, it's the seller. Besides, who would decide which transactions are fraudulent and which are not? Unless we just give everyone the chance to rollback their payments, which would create even more scams of buyers withholding legit transactions.

Anyway, Bitcoin is more like a wire transfer / cash payment in that if you got scammed, you go to the police or to the court. And for me, it's more sane than the credit card system, in which you give away all the identifying information online, but it doesn't really matter, because you can stop the transaction, except you can also do it when the goods have been already delivered, and also the seller can bill you anytime they want if you're not careful for e.g. your monthly subscription, which you can also rollback, except you've already used up 2 or 3 days and I don't even know what happens then.

-

@Maciejasjmj said:

Yeah, but then it's not a transaction that's fraudulent, it's the seller.

Most people don't give a shit about that distinction. Really.

-

@dkf said:

@Maciejasjmj said:

Yeah, but then it's not a transaction that's fraudulent, it's the seller.

Most people don't give a shit about that distinction. Really.While one usually implies another, there's still a distinction. If you order $10000 worth of Snickers bars for $9.95 and the scammers charge you $10000 and deliver (or not) the goods, it's obviously a fraud, but it's also an order which you did not authorize and your CC company should help you (aside from the police / court). If you, however, have been charged $9.95, then I don't see how the CC company comes into the equation - you have, after all, made the payment you've intended to, and it's the legal apparatus that should be concerned. Not the credit card issuer - on their side, everything looks fine.

It's like saying that when somebody steals a Post-It with your password from your monitor and logs into TDWTF, then TDWTF should hold any degree of responsibility.

-

My work hours are recorded in a system that seems to have been coded by the CEO's nephew on summer vacation. The password I entered at registration had an apostrophe, say "123'456". The next time, I couldn't log in. I guessed that the password had been sanitized and was now "123456".

-

@Maciejasjmj said:

While one usually implies another, there's still a distinction. If you order $10000 worth of Snickers bars for $9.95 and the scammers charge you $10000 and deliver (or not) the goods, it's obviously a fraud, but it's also an order which you did not authorize and your CC company should help you (aside from the police / court). If you, however, have been charged $9.95, then I don't see how the CC company comes into the equation - you have, after all, made the payment you've intended to, and it's the legal apparatus that should be concerned.

Oh, you're one of the libertoonian fuckers who thinks that contract law should be sacred beyond everything else? The world doesn't work in the way you seem to think it does.Here's how you get scammed in your system. You enter into a contract with someone (the scammer, though you don't know this) for them to provide you with a service in exchange for a payment. This is a normal thing to be doing. They refuse to start providing the service until they've received some sort of assurance that they will get paid. This is also normal (as it stops deadbeats, a definite problem in reality). With a direct bitcoin system you pay them and it clears. Now that they have the money, they provide either no service or just enough to fool you for long enough for them to leave town. You're now out of pocket. Of course, this is illegal, but the scammer just thinks you're a stupid patsy, a sucker who deserved to lose out.

The way to stop this is to have a reasonably trusted third party hold the funds between the point where you authorized the transfer and the point where it completes (most services aren't delivered over a long period of time with a single payment up front anyway; nobody really trusts the other party enough for that) giving an opportunity to prevent the transaction from happening if fraud is attempted, yet providing an assurance to an honest vendor that you're not a deadbeat. Or you could even have an account with the trusted third party that you then pay off from time to time. This last way is how a credit card actually works. That delay? That's your protection against scum.

None of this strictly requires dollars or prohibits bitcoins. You've just got to remember that bitcoins are cash and paying for things with cash has inherent dangers. (The downside of using a non-cash transaction is that it's easier for others — banks, governments, etc. — to see what you're doing, but that also makes it easier to sort out contract disagreements through the courts; that's a fundamental trade-off.)@Maciejasjmj said:

Not the credit card issuer - on their side, everything looks fine.

For some reason, that's not the position of a real CC issuer. They want to encourage you to use them (as the time when they're holding the money in transit permits them to use it for their own investments) so they work to discourage fraud.It's like saying that when somebody steals a Post-It with your password from your monitor and logs into TDWTF, then TDWTF should hold any degree of responsibility.

-

@Maciejasjmj said:

If someone steals your wallet on the street, do you also go to a bank for a refund?

Here in Australia, when someone steals your card details details (either physically or not) you actually do go to your bank for a refund.

They will refund you and give you a shiny new card.

-

@dkf said:

Bitcoin does work as an improved Money Transfer mechanism.

Improved how? It's still slower than snot, in fact not only is it slow, but your transaction has no guarantees on how long it'll take to get validated by enough miners. Can I do an emergency money transfer with Bitcoin to a friend in another country who needs groceries, and they can go out and buy those groceries? Can they get the money out of Bitcoin and back into their local currency before they starve to death? You sure can't in the US.

No, I'm sorry. Bitcoin is fucking terrible at everything it's trying to be. In addition to being a huge waste of electricity. The speculation is all there is.

-

@Maciejasjmj said:

And if somebody stole your private key, then you suck and deserve to be robbed, tough life.

I WANT TO USE A CURRENCY INVENTED BY PEOPLE WITH THIS ATTITUDE! PLEASE!

@Maciejasjmj said:

If someone steals your wallet on the street, do you also go to a bank for a refund?

That's the exact point. If someone steals my credit card, I can call up a 1-800 number and have it cancelled, and have all the transactions made on it between the time I lost it and the time it was cancelled refunded to me. If someone steals a index card with your Bitcoin wallet number thing on it, then you're just fucked. Why would I want to be fucked? Why would anybody?

@Maciejasjmj said:

And yeah, devices with gigabytes of storage very much can verify Bitcoin account and transactions. You know it's not 1999 and you can host such stuff in the cloud (which has already been done), and all you need is a thin client?

There are a lot of places in the world without "cloud connections" but which do want to run electronic transactions. In any case, my point still applies: whether or not you feel it's worthwhile, our old-fashioned credit card system supports a use-case which Bitcoin does not. This is because Bitcoin is an awful implementation of a pretty-good-actually idea. There is not one single thing Bitcoin improves on over what came before.

-

@blakeyrat said:

Can I do an emergency money transfer with Bitcoin to a friend in another country who needs groceries, and they can go out and buy those groceries? Can they get the money out of Bitcoin and back into their local currency before they starve to death?

I wouldn't know. I don't trust it enough for a replacement for banking or credit cards — I like being able to double-check stuff — and the way the bitcoin community is full of speculators and criminals just makes me want to stay away. I don't view the government as being the number 1 threat to my finances.Well, I do, but in other ways. Nothing to do with currencies or financial transactions.

-

@blakeyrat said:

Why would I want to be fucked? Why would anybody?

Typically for the pleasure of it, with a healthy side of ego boost.

Sorry, was it a trick question?

-

@Ben L. said:

@Maciejasjmj said:

@anonymous234 said:

@Maciejasjmj said:

What I'm still surprised about is that online stores require all various kind of authenticating information... all of which are found on the very card itself. Here in Poland, some banks implement extensions to that - for example, my bank requires me to log into my Internet account and provide a SMS token - but I've still seen a lot of places where if you have a card, no matter if it's actually yours or not, you can buy whatever the hell you like. Just put that CVV code on a separate piece of paper when you give me a card, goddamnit.

Great, you just made Bitcoin seem like a sane system by comparison. (which it actually is even though community's shit)

Technically, the comic showed that bitcoin is a better method of transferring money than credit cards. Which is true.

No, it isn't. See, the problem in the comic is that the comic equating the wrong things. The purchaser sending the credit card info string to the seller is ITSELF the initiation of the transaction. It's like a bitcoin purchaser sending his bitcoin address. The only difference is that in bitcoin, you have to create a seperate address for every transaction or risk the seller stealing all your cash. While with a credit card, you can reuse the same credit card over and over again without the risk of the other party taking everything you own.The thing about money transfers is that there were never any technical limitations preventing people from transferring money. The limitations were all structural and designed specifically to (a) protect consumers and (b) prevent money laundering. Hence why the only purpose that bitcoin could ever have was in fostering money laudering. Cause who the fuck would be dumb enough to want to get rid of consumer protection intentionally?

-

Lolwhut? How does not creating a specific address to send money give others the possibility of taking your bitcoin?

Please elaborate because this sounds very interesting.

-

@dkf said:

[CC firms] want to encourage you to use [CC's] (as the time when they're holding the money in transit permits them to use it for their own investments)

No, that's not how they make their money; they take a slice of the transaction, either a fixed amount, minimum amount, and/or a percentage of the transaction; anything from 2-5% depending on the network (Amex tend to charge the most, hence the reason some businesses refuse to take them.)

-

@PJH said:

No, that's not how they make their money; they take a slice of the transaction, either a fixed amount, minimum amount, and/or a percentage of the transaction; anything from 2-5% depending on the network (Amex tend to charge the most, hence the reason some businesses refuse to take them.)

Isn't the main way how they make their money by having people pay interest because they don't pay off their cards in time (or only pay some minimum amount)?

-

@ender said:

@PJH said:

Maybe, but:No, that's not how they make their money; they take a slice of the transaction, either a fixed amount, minimum amount, and/or a percentage of the transaction; anything from 2-5% depending on the network (Amex tend to charge the most, hence the reason some businesses refuse to take them.)

Isn't the main way how they make their money by having people pay interest because they don't pay off their cards in time (or only pay some minimum amount)?Myth: Most cardholders only ever make the minimum payment

Reality: This is not true. Most people (around 60%) say that they pay-off their balance in full each month and therefore pay no interest. Customers benefit from the flexibility of paying an amount that suits them each month and this will sometimes be the minimum payment. We know that less than 4% of customers tend to pay the minimum for 12 consecutive months.

-

@Snooder said:

No, it isn't. See, the problem in the comic is that the comic equating the wrong things. The purchaser sending the credit card info string to the seller is ITSELF the initiation of the transaction. It's like a bitcoin purchaser sending his bitcoin address. The only difference is that in bitcoin, you have to create a seperate address for every transaction or risk the seller stealing all your cash. While with a credit card, you can reuse the same credit card over and over again without the risk of the other party taking everything you own.

Ummm... no. This is exactly backwards.

When I send BTC to a certain address, that transaction is signed with a private key. The recipient (and everyone else with access to the block chain) can verify the transaction by checking it with the corresponding public key, but nobody other than me has the information required to generate another verifiable transaction against any of my BTC.

With a CC, there is no transaction signature at all. Any recipient of my CC info - be that a legit merchant, or a thief who has skimmed it in transit - has all the information they need to create an arbitrary sequence of transactions against my CC account; not only that, but there is no technical measure in place ensuring that the amount the merchant takes from me is the amount I intended to pay. The only reasons this doesn't usually cause trouble are that merchants have reputations to protect and transactions are reversible without the recipient's consent.

-

@Snooder said:

in bitcoin, you have to create a seperate address for every transaction or risk the seller stealing all your cash.

The reason BTC best practice involves creating a separate address for each transaction is to make it more difficult to tie all your transactions to you. If you're not fussed about anonymity theatre, you can safely re-use the same wallet address for every single transaction you ever make. The only way any of your BTC wallets can ever have BTC stolen from them is if somebody other than you has access to their private keys.

-

@ender said:

@PJH said:

No, that's not how they make their money; they take a slice of the transaction, either a fixed amount, minimum amount, and/or a percentage of the transaction; anything from 2-5% depending on the network (Amex tend to charge the most, hence the reason some businesses refuse to take them.)

Isn't the main way how they make their money by having people pay interest because they don't pay off their cards in time (or only pay some minimum amount)?I have heard, secondhand but with the first hand supposedly having been someone who worked for a credit card company, that what the CC companies internally call "deadbeat accounts" are the accounts that are paid off in full every month and seldom incur any special service fees.

-

@kilroo said:

I have heard, secondhand but with the first hand supposedly having been someone who worked for a credit card company, that what the CC companies internally call "deadbeat accounts" are the accounts that are paid off in full every month and seldom incur any special service fees.

Citation.

-

@DCRoss said:

Even better, https://ismycreditcardstolen.com/

You mean things like the certificate expiring in 2007? Very subtle. :)There are some very subtle and hard to spot irregularities with their SSL certificate which would require a cryptography expert to identify.